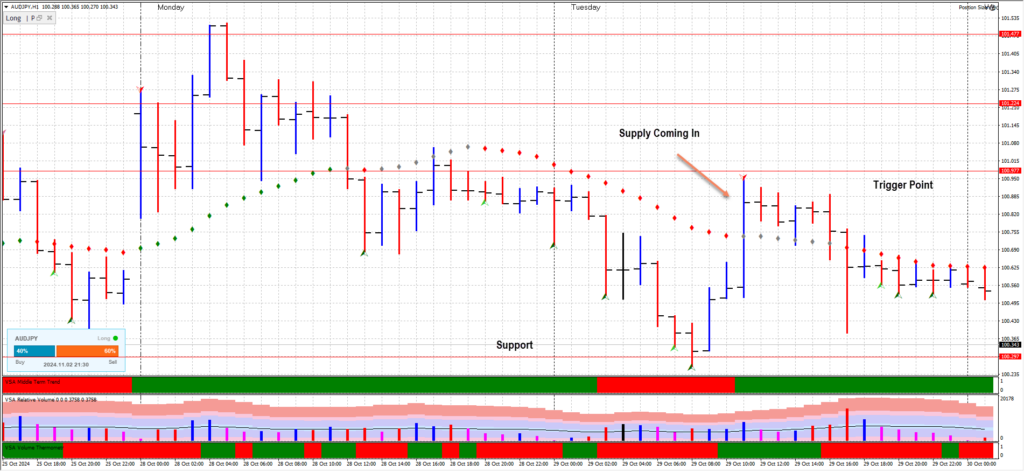

Monday, October 28, 2024

Monday’s price action fits well into Wyckoff’s phases of accumulation, distribution, and supply-demand testing. The session began with ultra-low volume, reflecting a lack of strong interest from both buyers and sellers—a condition that typically occurs when the market is still absorbing previous supply. This opening action took place around a level of prior high volume from the previous Thursday, suggesting that the market was still evaluating the absorbed supply. The initial sideways movement, combined with indecisive price bars, hinted at a possible accumulation phase, where larger players might have been quietly gathering positions without driving prices higher.

As the session progressed, the price rallied towards the 101.50 resistance, an area previously marked by supply on Wednesday. This rally occurred on high volume, which often indicates a supply test in Wyckoff terms—a situation where larger players push prices higher to observe the presence of sellers. The reversal after reaching this level resembled a classic Wyckoff upthrust, where the price tests resistance, attracting sellers who subsequently drive the price back down. This reaction confirmed that supply remained dominant, leading to a decline shortly after the test.

Following this, the price dropped back to a “no-demand” zone, formed early in the session. Here, the market entered a low-volume consolidation phase, aligning with Wyckoff’s reaccumulation or secondary test concepts, as the market assessed whether selling pressure had indeed diminished. An attempt to break below the trigger point—a minor support level—was quickly rejected, as the price rallied back up, indicating insufficient selling strength at those lower levels.

The session concluded with a widespread down bar, which breached the trigger point but showed relatively low volume, suggesting a lack of aggressive selling. This bar closed off the lows, followed by an up-bar, signaling buying interest entering at lower levels. This buying interest without overt strength aligns with Wyckoff’s “hidden demand” concept, where larger players accumulate quietly. By the end of the session, the price retested the trigger point, facing resistance and ultimately consolidating. Overall, Monday’s action suggested a testing phase of supply and demand, with larger players potentially accumulating at lower prices in preparation for a move higher.

Tuesday, October 29, 2024

Tuesday began with prices near Monday’s consolidation zone, showing continued indecision. Early in the session, the price attempted to break upward, forming an up-bar on increased volume. However, this volume did not reach ultra-high levels, implying a lack of committed buying interest, and supply began to emerge. This push-up followed by rejection was a sign of Wyckoff’s upthrust action, where prices rise to test demand but are met by supply.

The price soon reversed into a downward trend, marked by a series of down bars without significant volume increase, indicative of a controlled descent rather than panic selling. Minor buying activity was present, as evidenced by occasional green markers in the trend, yet it was insufficient to halt the decline. Mid-session, the price reached a key support area, defined by a previous trigger level, where volume slightly increased. However, this volume was not enough to reverse the downtrend, as selling pressure continued to overwhelm buying attempts.

Later in the day, the price broke below the support level, confirmed by a widespread down bar on slightly higher volume. This move signaled sellers’ control, holding the price below the broken support for the remainder of the session. Wyckoff’s concept of “supply overcoming demand” was evident, with sellers firmly in control. The VSA (Volume Spread Analysis) indicators also reflected this bearish sentiment, showing a predominant red zone in the middle trend, consistent with a downtrend. Tuesday’s session confirmed bearish control, with the price holding under the broken support level and pointing towards continued weakness.

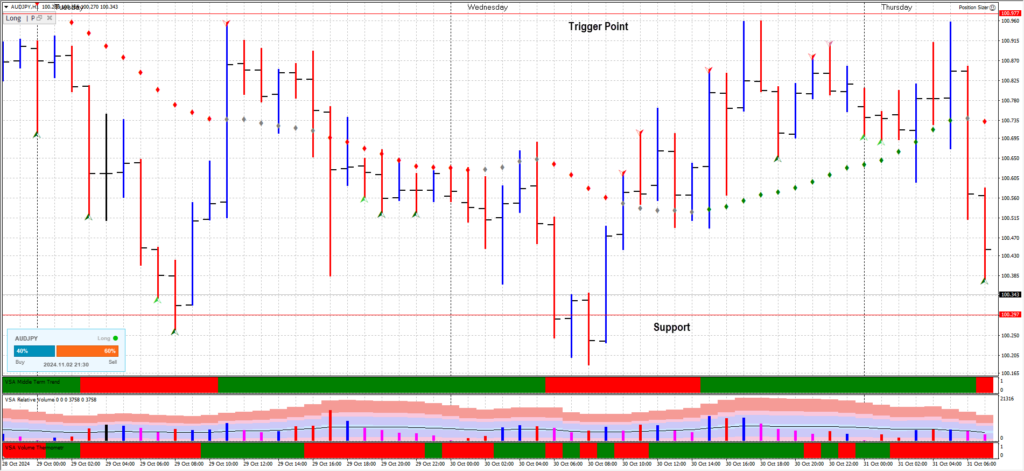

Wednesday, October 30, 2024

Wednesday’s session continued the bearish trend but showed initial signs of potential support and emerging buyer interest. Price opened near Tuesday’s low, affirming sellers’ early control. Initially, the price drifted downward, testing the 100.50 level, yet this move lacked the strong selling seen earlier in the week. Instead, price action became more measured, consolidating between 100.50 and 100.70 in narrow-range bars. This pause in downward movement, marked by low-volume indecision bars, suggested a potential accumulation phase where sellers might be losing momentum.

Volume remained low during the declines, as on Tuesday, indicating a possible seller exhaustion phase. The absence of high-volume down bars hinted that sellers lacked strong conviction, and a reversal could be forming if buyers began to show interest. Midway through the session, a brief rally lifted the price from 100.70 to 100.80, but resistance quickly emerged, showing that sellers were still active and defending this level. The price then drifted back down as buyers lacked sufficient strength to break through.

Late in the session, price retested support around 100.30, bouncing off this level, which hinted at buyer accumulation. The bounce suggested that buyers were beginning to step in to protect this level, likely viewing it as a key support area. Closing off the lows was a subtle indication of changing sentiment, though the low volume on the rally showed buyers were not yet committed. Wednesday pointed to a weakening of selling pressure, with hints of buyer interest, though further confirmation was required for a bullish shift.

Thursday, October 31, 2024

Thursday’s session maintained a bearish tone, yet key volume patterns hinted at a potential market shift. The session opened near Wednesday’s lows, and while there was an initial attempt to rally, resistance at the 100.50 level quickly sent the price back down. This decline, however, showed low volume, revealing a lack of committed selling pressure and suggesting that sellers were beginning to lose momentum.

As the session progressed, the price moved into a consolidation phase around 100.00–100.20, with volume remaining mostly low to moderate. Each attempt to push lower failed to generate ultra-high volume, reinforcing the idea of seller exhaustion. Price drifted sideways within a narrow range, showing that sellers were no longer aggressively pushing the market down, and hinting at a possible end to the current distribution phase.

Toward the end of the day, the price saw a small rebound, closing slightly off the lows. This upward move was on increased volume, though not reaching ultra-high levels, suggesting some buying interest. This closing action implied buyers were beginning to step in cautiously, though without significant strength. Thursday’s session pointed to a potential accumulation phase, as sellers showed less aggression and buyers appeared interested in supporting prices.

Friday, November 1, 2024

Friday opened with a stronger bullish undertone, with increased buying interest showing as the session unfolded. Initially, the price dipped to test Thursday’s support, but buyers quickly stepped in, igniting a rally that breached the 100.50 resistance level. This rally was accompanied by very high to ultra-high volume, signaling a decisive influx of demand, as buyers entered the market with conviction—a clear sign of a potential reversal under Wyckoff’s methodology.

As the session progressed, the price consolidated around 100.50. The volume during this consolidation phase gradually declined, suggesting a healthy pause rather than a lack of buying interest. Wyckoff’s concept of “backing up to the edge of the creek” applied here, as the price held above the previous resistance level, indicating that buyers were prepared to defend this area. Each attempt by sellers to push prices lower was met with support, and the absence of high-volume selling on these dips reinforced that sellers had lost dominance.

By the end of the session, the price was holding above 100.30, showing resilience in sustaining the week’s gains. The ultra-high volume during the rally earlier in the day, combined with the ability to hold these gains on lower volume, suggested that the market was transitioning into an accumulation phase with buyers taking control. This shift in volume patterns—from low-volume declines on Thursday to ultra-high volume on Friday’s rally—signaled a clear change in trend. A strong bullish reversal could be confirmed in the following sessions if buyers break above the 100.70–100.80 resistance zone on high volume, in line with Wyckoff’s principles of successful accumulation.