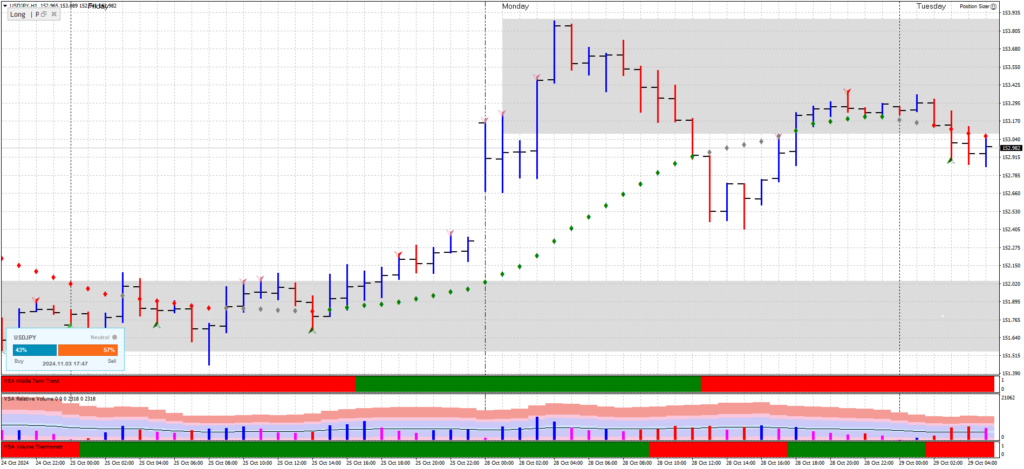

Monday, October 28, 2024

Opening Rally on Moderate Volume: The session began with a strong upward movement on moderate volume, showing that buyers were eager but not yet fully committed. The price quickly rose to test a resistance level of around 153.00, which had acted as a ceiling previously. This moderate volume on the up move suggested that some buyers were stepping in, but without the conviction typically seen in a strong trend shift.

High Volume Reversal from Resistance: Midway through the session, as the price tested the 153.00 resistance level, volume spiked, indicating significant selling pressure. The appearance of high volume near resistance aligns with Wyckoff’s “upthrust” scenario, where price tests a resistance level only to be met with supply. This reversal from resistance on high volume suggested that sellers were actively defending this level.

Late-Session Consolidation with Decreasing Volume: Toward the end of the day, the price consolidated just below the 153.00 level with decreasing volume, indicating a lack of aggressive selling. This consolidation phase with lower volume signaled a potential absorption of supply at this level, as sellers were losing strength, but buyers were not yet prepared to push through resistance.

Tuesday, October 29, 2024

Early Session Rally with High Volume: The session opened with another rally attempt toward 153.00, but this time on higher volume compared to Monday. This increase in volume showed that buyers were testing the strength of sellers at the resistance level. However, the fact that the price struggled to break above 153.00 on high volume suggested that supply was still prevalent.

Sharp Reversal with Ultra-High Volume: As the day progressed, the price quickly reversed from the resistance level, resulting in a sharp down move with ultra-high volume. This ultra-high volume on a down move confirmed that sellers were heavily defending the 153.00 level, indicating strong supply in Wyckoff terms. This type of price action is often associated with a “distribution” phase, where larger players are offloading positions at higher prices.

End-of-Day Decline with Moderate Volume: After the initial sharp reversal, the price continued to decline on moderate volume, closing near the session low. This steady decline suggested that sellers remained in control, but without the aggressive selling seen earlier in the session. The day ended with clear bearish sentiment as the resistance at 153.00 was firmly established.

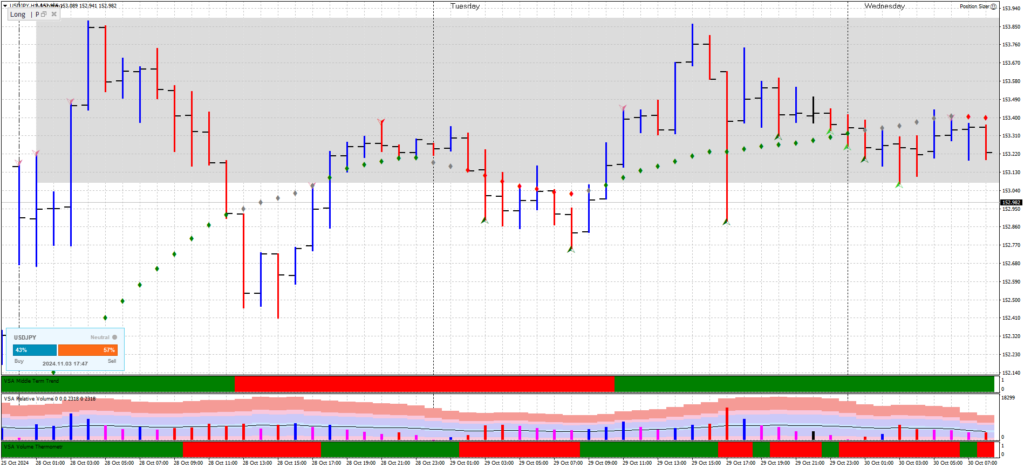

Wednesday, October 30, 2024

Opening Weakness with Low Volume: Wednesday’s session began with price drifting lower on low volume, indicating that sellers were still dominant, but there was no aggressive selling pressure. This low-volume decline fits with Wyckoff’s “testing” phase, where price drifts lower as the market gauges if there is any residual demand at these lower levels.

Mid-Session Attempt to Rally with Moderate Volume: Midway through the session, there was an attempt to rally back towards the 152.60 level, with price moving up on moderate volume. This moderate volume suggested that buyers were stepping in cautiously, but the absence of high volume indicated that they were not fully committed to reversing the trend. The rally stalled at 152.60, showing that sellers were still defending lower levels of resistance.

Late-Session Decline with Increasing Volume: Toward the end of the session, the price began to drift lower again, this time with an increase in volume. This increase in volume on the down move indicated that sellers were reasserting control, and the day ended near the session low, suggesting that the bearish sentiment was still intact. This price action aligns with Wyckoff’s concept of a distribution phase, where selling pressure is dominant.

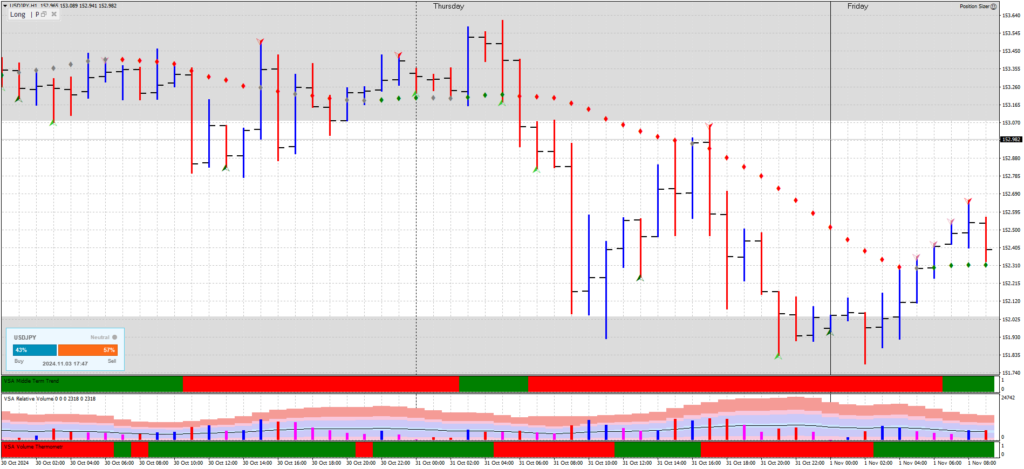

Thursday, October 31, 2024

Early Session Rally with High Volume: Thursday opened with a strong rally attempt, pushing the price back up towards the 152.80 level on high volume. This high volume indicated that buyers were aggressively testing resistance again. However, the rally faced resistance near 152.80, suggesting that sellers were still active at these higher levels.

Reversal and Downward Movement with Very High Volume: Midway through the session, the price sharply reversed from the 152.80 level, moving downward with very high volume. This volume spike on a down move indicates strong selling pressure and reinforces the idea of a distribution phase, as sellers continue to unload positions at higher prices. The reversal on very high volume suggests that supply is still in control of the market.

End-of-Day Consolidation with Lower Volume: By the end of the session, the price settled into a consolidation phase around the 152.20 level with decreasing volume. This decrease in volume during consolidation indicated a temporary balance between buyers and sellers, with neither side dominating the market. However, the high-volume reversal earlier in the session hinted that sellers were likely to retain control.

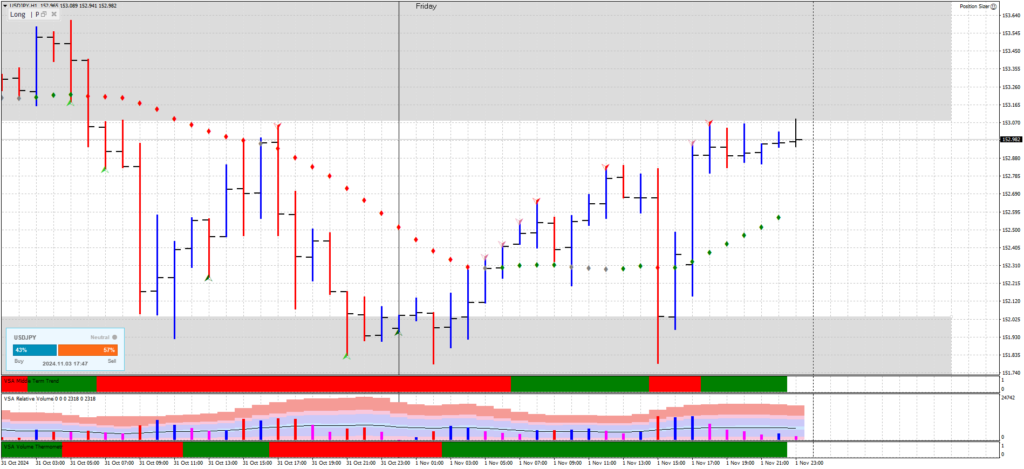

Friday, November 1, 2024

Opening Rally with Ultra-High Volume: The session opened with a strong rally as the price pushed up towards the 153.00 resistance level again, this time on ultra-high volume. This ultra-high volume on an upward move is a Wyckoff “sign of strength,” where large players step in aggressively to test if sellers are still defending resistance. The ultra-high volume indicated strong buyer interest, suggesting that buyers were ready to attempt a breakout.

Mid-Session Breakout Above Resistance with Very High Volume: Midway through the day, the price finally broke above the 153.00 resistance level on very high volume, confirming that buyers had taken control. This breakout above resistance with substantial volume signalled the end of the accumulation phase and the beginning of a potential uptrend. In Wyckoff terms, this breakout on very high volume reflects a “change of character,” where the market transitions from a distribution or testing phase to a bullish trend.

Late-Session Consolidation Above Resistance with Declining Volume: After breaking above the 153.00 level, the price consolidated above this new support area, with volume gradually decreasing. This declining volume on a consolidation after a breakout is often referred to as “backing up to the creek” in Wyckoff methodology, where the price pauses to confirm that former resistance is now acting as support.

End-of-Week Close with Bullish Bias: The week ended with price holding above the 153.00 level, indicating that buyers were in control. The breakout with ultra-high volume earlier in the day, followed by consolidation on low volume, suggests that the market has successfully transitioned to an uptrend, with strong buyer interest likely to continue into the next week.

Summary

Throughout the week, USDJPY exhibited clear signs of Wyckoff distribution near the 153.00 resistance level until Friday, when buyers finally gained control. Key takeaways:

- 153.00 Resistance Zone: This level served as a key resistance throughout the week, with high to ultra-high volume reactions each time the price approached it.

- Distribution to Accumulation Transition: The high and ultra-high volume rejections early in the week hinted at distribution, while Friday’s breakout above 153.00 marked a shift to accumulation as buyers took control.

- Volume Signals: Ultra-high volume on Friday’s breakout confirmed a “sign of strength,” signalling that a bullish reversal was underway.

Moving forward, further bullish confirmation would require continued strength above the 153.00–153.20 range, ideally with sustained high volume to reinforce the breakout.