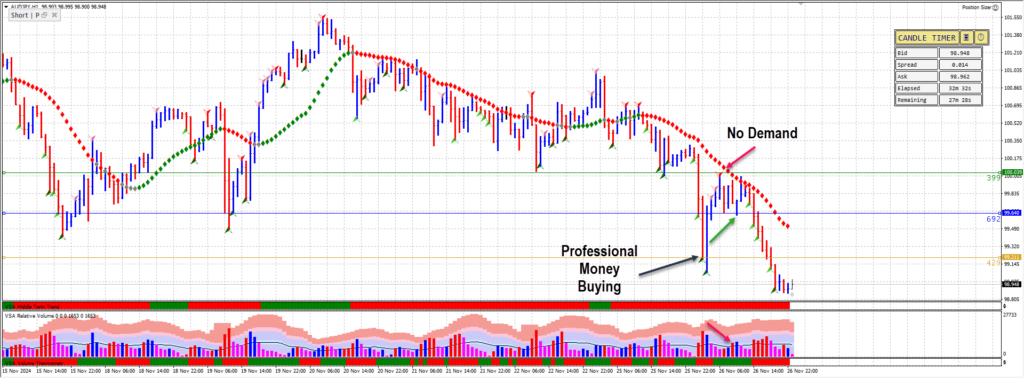

The trade on AUDJPY was based on a retest of the ultra-high volume zone, signaling professional activity. An ultra-high volume widespread down bar indicated strong buying by professionals absorbing supply. Following this, the price rallied with diminishing volume, culminating in a no-demand bar—a classic sign of waning bullish interest. The trade entry was triggered upon confirmation of the no-demand bar. After entry, prices came very close to the stop loss level but failed to break above the no-demand bar, reinforcing the validity of the setup. The position was managed with a single profit target, prioritizing a realistic 1:1 risk-to-reward ratio over aiming for 1:3, given the context and higher confidence in achieving the smaller target.

The End Result

| Trade Entry Date / Time: 26/11/2024 10:12:30 UTC |

| Symbol: AUD/JPY |

| Type: Sell |

| Entry Price: 99.640 |

| Position Size: 3.93 |

| Commission: -12.73 |

| Swap: 0.00 |

| Trade Exit: 99.211 |

| Trade Pips: 42.9 Pips |

| Profit: $1098.97 |

| Profit %: 1.06 |

Lessons Learned

Volume Analysis is Key: Identifying ultra-high volume zones and their significance in professional activity can provide high-probability trade setups.

Patience in Setup Confirmation: Waiting for the confirmation of the no-demand bar ensured a more reliable entry point, aligning with the Wyckoff methodology.

Adaptation in Profit Targets: Adjusting profit expectations to the market conditions—opting for a 1:1 risk-to-reward ratio instead of a 1:3—highlighted the importance of flexibility and realistic goal setting.

Risk Management is Crucial: Even with high confidence in the trade setup, adhering to defined targets and managing expectations reinforced disciplined trading.

Understanding Market Context: Recognizing that the market dynamics didn’t support a larger reward helped avoid over-optimism, enhancing the probability of a successful trade.

Leave a Reply