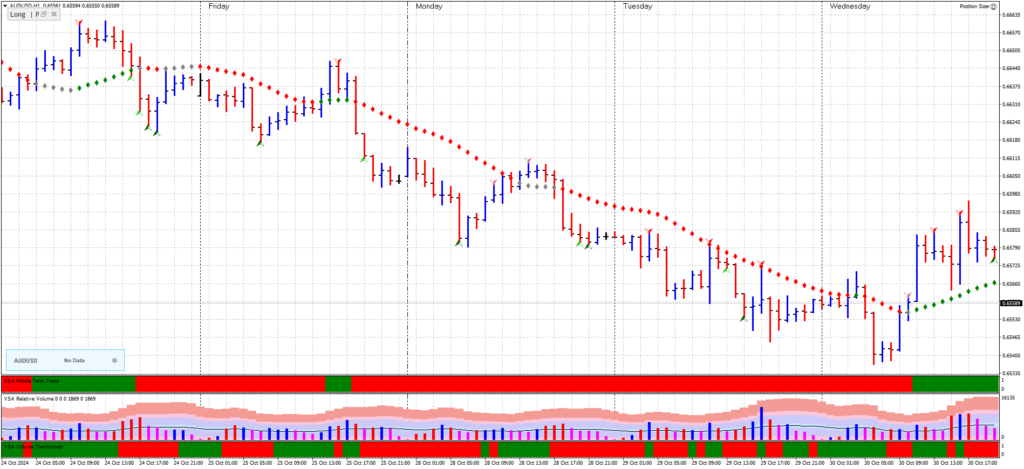

Monday, October 28, 2024

Opening Action: The session began with a downtrend continuation, with moderate volume on the initial price bars. This opening indicated that sellers were still active, but without high or ultra-high volume, suggesting that the selling pressure was not overwhelming.

Mid-Session Rally and Volume Spike: Midway through the session, there was an attempt by buyers to lift the price, which brought the price back up slightly. This rally, however, occurred on low volume, hinting that there was little demand to sustain an upward move. This aligns with Wyckoff’s “no demand” scenario, where a low-volume rally often indicates that buyers are weak, and sellers may take advantage of this lack of demand to push prices lower.

Late-Session Decline with Volume Increase: Later in the day, the price began to decline again, and this move downward saw a gradual increase in volume. This volume increase suggests that supply was becoming more prominent as sellers continued to step in. By the end of the session, the price closed near the day’s low, with volume slightly above average. This setup indicates that sellers were in control, but without ultra-high volume, the selling pressure was not extreme.

Key Levels and Wyckoff Interpretation: The key support level around 0.6600 held as a temporary stopping point. However, Monday’s action pointed to a potential redistribution phase rather than accumulation, as buyers lacked the strength to absorb the supply at that level.

Tuesday, October 29, 2024

Early Session Upthrust with Moderate Volume: The day started near Monday’s low, with an initial attempt to push higher. The price briefly rallied on moderate volume, creating an upthrust bar. This upthrust aligns with Wyckoff’s notion of a “test of supply,” where price attempts to rise to gauge seller interest. The moderate volume during this rally suggested that buying interest was still weak.

Controlled Downward Trend with Low Volume: After the failed upthrust, the price gradually declined, with each down bar showing low to moderate volume. This controlled decline fits Wyckoff’s description of a markdown phase without panic selling, as sellers continued to exert control but without causing a major drop in volume. This low-volume descent indicated that there was no aggressive selling pressure, likely because buyers were showing some resilience.

Support Level Test with Ultra-High Volume: Mid-session, the price reached a support area around 0.6560, where volume suddenly spiked to ultra-high levels. This spike in volume suggested that buyers were accumulating positions at this level, absorbing supply as sellers tried to break lower. The presence of ultra-high volume without a significant price drop pointed to absorption, as larger players likely viewed this area as a value zone for accumulation.

Late Session Consolidation: Toward the end of the day, the price began to consolidate in a narrow range with decreasing volume. This consolidation after a high-volume test suggests a preliminary support phase in Wyckoff terms, where the market is starting to shift from distribution to accumulation as supply becomes absorbed.

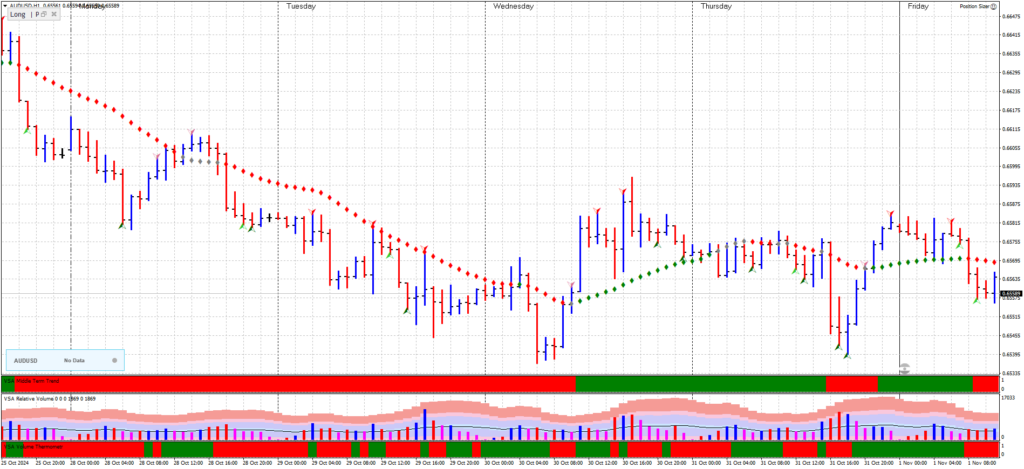

Wednesday, October 30, 2024

Opening Action with Low Volume Rally: The session opened just above the previous day’s low, with a minor rally attempt on low volume. This low-volume rally indicated that demand was weak, and buyers were hesitant to push the price significantly higher. In Wyckoff methodology, such low-volume rallies can be a sign that demand is not yet strong enough to reverse the downtrend.

Downward Drift and Low Volume: After the weak rally, the price began to drift lower in a controlled manner, with each bar showing low volume. This low-volume decline suggested that sellers were not as aggressive, possibly indicating exhaustion after the prior days’ selling. Wyckoff describes this as a “testing phase,” where the market is probing lower prices to see if any strong selling interest remains.

Brief Rally with Moderate Volume Mid-Session: Midway through the day, there was a brief attempt to rally up to 0.6580, accompanied by moderate volume. The moderate volume indicated that some buyers were stepping in, but it was not strong enough to signal a major accumulation. The rally stalled at 0.6580, confirming that sellers were still defending resistance levels actively.

End-of-Day Support Test with Low Volume: Near the close, the price tested the 0.6560 support level again. Volume remained low during this test, suggesting that sellers were losing momentum. This low volume on a support test indicates potential accumulation, as buyers might be waiting for a more favorable level to absorb the remaining supply.

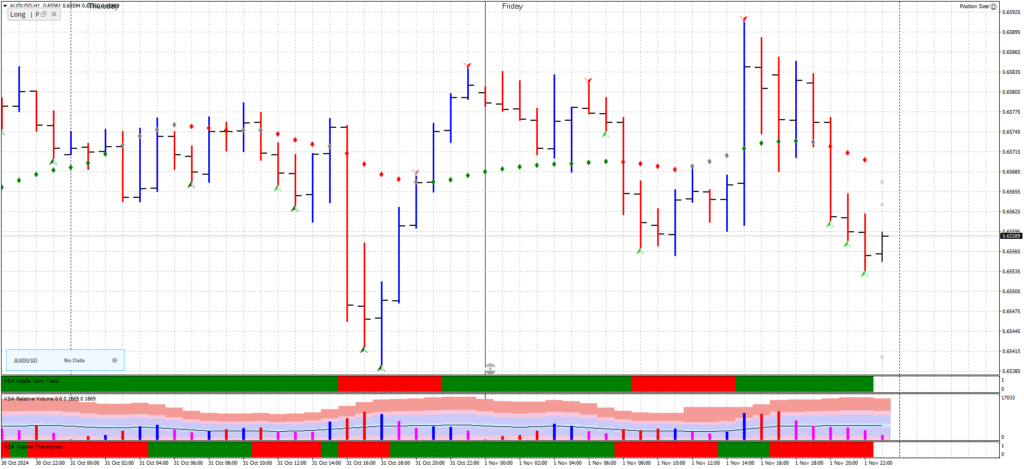

Thursday, October 31, 2024

Opening Rally with Moderate to High Volume: Thursday’s session opened with a noticeable rally, pushing price higher on moderate to high volume. This increase in volume on an up move suggested that buyers were gaining confidence and testing resistance levels more aggressively. This move could be a “preliminary support” in Wyckoff terms, where buyers are beginning to absorb supply in preparation for a more substantial rally.

Resistance at 0.6595 and Volume Decline: The price moved up toward the 0.6595 resistance level, where it encountered selling pressure. As the price reached this level, volume began to decline, indicating that buyers were not yet fully committed to a breakout. This fits with Wyckoff’s “backing up” phase, where price stalls near resistance without the volume to push through.

Mid-Session Consolidation with Low Volume: Throughout the middle of the session, price consolidated just below 0.6595 with low volume. This consolidation with decreasing volume hinted at potential re-accumulation, as larger players might have been waiting for a stronger demand signal before initiating more buying.

End-of-Day Breakout Attempt with High Volume: Toward the end of the session, the price made another attempt to break above resistance, this time on high volume. This high volume indicated that buyers were more committed, and the session closed near the highs, suggesting that the accumulation phase might be nearing completion.

Friday, November 1, 2024

Early Session Breakout with Ultra-High Volume: Friday’s session opened with a strong breakout above the 0.6595 resistance level, supported by ultra-high volume. This ultra-high volume on an upward move is a clear Wyckoff “sign of strength,” indicating that large players were actively buying in anticipation of a sustained move higher.

Mid-Session Consolidation with Declining Volume: After breaking above resistance, the price consolidated above 0.6595 with gradually declining volume. This pattern fits Wyckoff’s “backing up to the edge of the creek,” where the price pauses to confirm that former resistance has become support. The declining volume indicated a healthy consolidation rather than a loss of buying interest.

Final Upward Move and Closing Strength: Toward the end of the session, the price made a final push higher on moderate volume, closing near the highs of the week. This price action suggested that buyers were firmly in control, and the week ended with a strong upward bias.

Key Levels and Wyckoff Interpretation: The breakout above 0.6595 with ultra-high volume confirmed the accumulation phase, and the ability to hold above this level with declining volume reinforced that the market was preparing for a continuation of the uptrend. For the following sessions, further strength above 0.6605 with high volume would validate the bullish reversal.

Summary

The week in AUDUSD, analyzed through Wyckoff methodology, showed a clear transition from a markdown phase early in the week to a confirmed accumulation phase by Friday. The initial signs of absorption on ultra-high volume at support on Tuesday and Wednesday were confirmed by high-volume rallies on Thursday and Friday. Friday’s ultra-high volume breakout provided a strong indication that larger players had completed accumulation, setting up for a bullish reversal. For continued bullishness, it’s essential to see follow-through buying with high volume in the upcoming sessions.