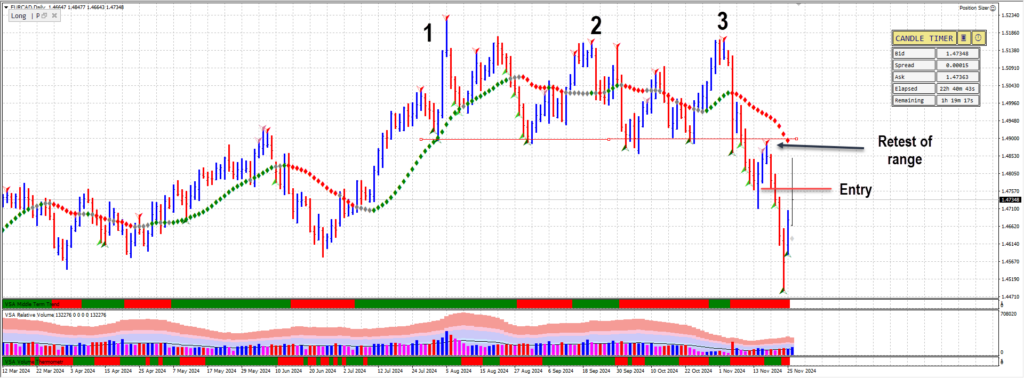

The trade on EUR/CAD was based on observations from the daily chart, revealing a classic distribution phase orchestrated by Composite Operators (Smart Money). The first key signal appeared on August 2, 2024 (Point 1) with a widespread down-bar on ultra-high volume, closing near the bottom of its range. This indicated institutional selling disguised as strength, likely intended to entice retail traders into long positions.

Subsequent price action showed retests of the highs accompanied by supply bars, evidenced by up-bars closing below their highs and diminishing demand. The appearance of no-demand bars and an upthrust (Point 2) confirmed weakening buying pressure as Composite Operators continued distributing their positions.

As the price consolidated further, volume diminished significantly, suggesting absorption was nearing completion. During the final retest of the highs at Point 3, an ultra-low-volume no-demand bar formed, indicating a lack of interest in higher prices from Smart Money.

The tipping point came with a widespread down-bar on ultra-high volume, marking a selling climax. While the next bar attempted an automatic rally, it lacked conviction, closing near the middle of its range. The subsequent down bar confirmed the failure to sustain an upward move, leading to a break below the trading range.

After the breakdown, price action revisited the range for a retest, where another no-demand bar appeared. This bar was confirmed by the next, triggering an entry on the break of the confirmed no-demand bar’s low. This precise setup, aligned with Wyckoff principles of distribution and no-demand confirmation, formed the basis for the trade.

After entering the trade, my initial profit target was reached within a couple of days, prompting me to adjust my stop-loss to just below the entry point to protect profits. However, I chose to exit the position early due to emerging Wyckoff signals of strength. A widespread down-bar closing in the middle of the range appeared, typically a sign of absorption by Composite Operators, indicating the potential for upward movement. This was further confirmed by the following up-bar, which demonstrated increased demand entering the market. Recognizing the shift in supply and demand dynamics, I exited the trade to secure my gains.

The End Result

| Trade 1 | Trade 2 |

|---|---|

| Trade Entry Date / Time: 20/11/2024 10:01:41 UTC | Trade Entry Date / Time: 20/11/2024 10:01:41 UTC |

| Symbol: EUR/CAD | Symbol: EUR/CAD |

| Type: Sell | Type: Sell |

| Entry Price: 1.47646 | Entry Price: 1.47646 |

| Position Size: 0.50 | Position Size: 0.50 |

| Commission: -2.64 | Commission: -2.64 |

| Swap: -2.79 | Swap: -6.04 |

| Trade Exit: 1.46269 | Trade Exit: 1.46852 |

| Trade Pips: 137.7 Pips | Trade Pips: 79.4 |

| Profit: $493.06 | Profit: $283.81 |

| Profit %: 0.47 | Profit %: 0.27 |

Lessons Learned

Adapting to Changing Market Conditions

- I noticed a shift in supply and demand dynamics, with strength coming in, and I adjusted my position accordingly. By closing the trade early, I prioritized protecting my gains over sticking rigidly to my trade plan.

- What I learned: I need to stay flexible and be ready to act when the market provides new evidence, even if it means deviating from my initial plan.

2. The Importance of Volume and Price Analysis

- I identified key signals, such as the widespread down-bar closing near its lows and the subsequent up-bar, which indicated absorption and the presence of demand.

- What I learned: My ability to analyze volume and price action is improving, and I should continue to refine these skills to anticipate shifts in market behaviour with more confidence.

3. Proactive Risk Management

- After hitting my first profit target, I moved my stop-loss to just below the entry point, ensuring I protected my gains. This helped me avoid turning a winning trade into a losing one.

- What I learned: Active risk management is essential, and I’m on the right track by securing profits and managing risk throughout the trade.

4. Trusting Wyckoff Principles

- My decision to exit early was based on clear Wyckoffian signals like absorption and demand entering the market. Trusting these signals gave me the confidence to make a quick decision.

- What I learned: I can trust the Wyckoff principles I’ve studied, but I should continue to refine my understanding through experience and observation.

Leave a Reply