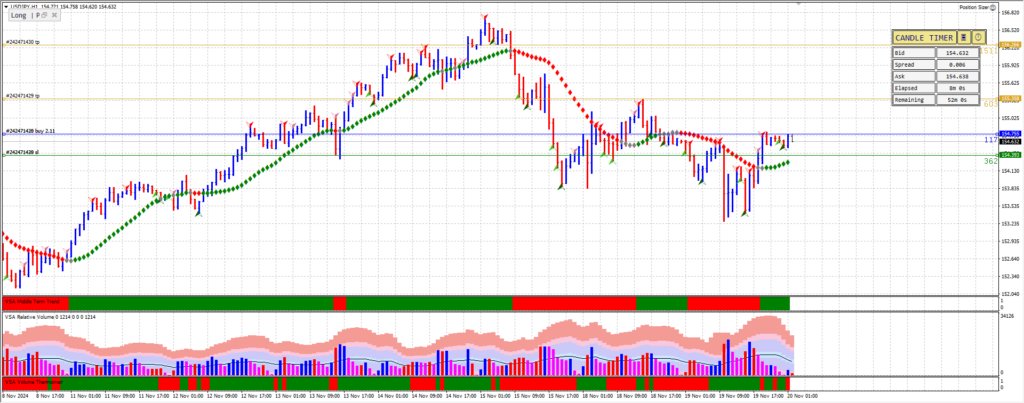

The following trade has been entered due to smart money activity on the 19th of November 2024.

The Setup

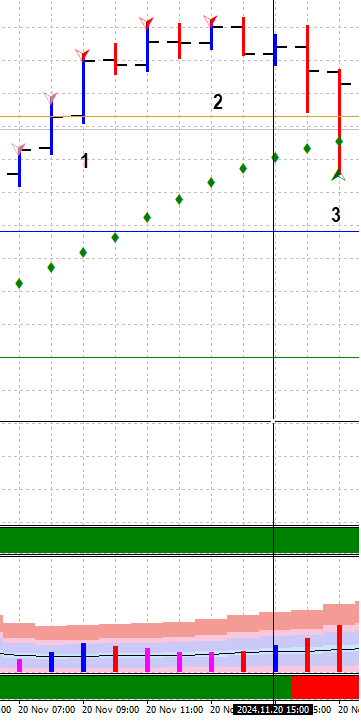

From the screenshot below we can see a widespread down bar closing off the lows with ultra-high volume. The next bar also had ultra-high volume and closed in the middle of the range. The price rallied on low volume then dropped back into the lows, The price was testing those lows. After the test, there is an up bar with high volume which has caused the currency to rally towards the high of the ultra-high volume bar, which I call the trigger point.

At the trigger point, the price retraced on decreasing volume. The final down bar had ultra-low volume, and the next bar was up on increased volume. This was confirmation for this trade.

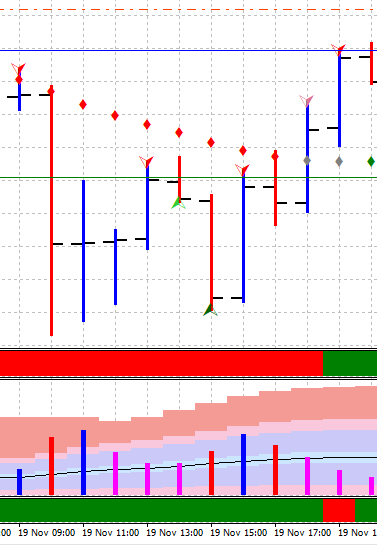

First Profit Target

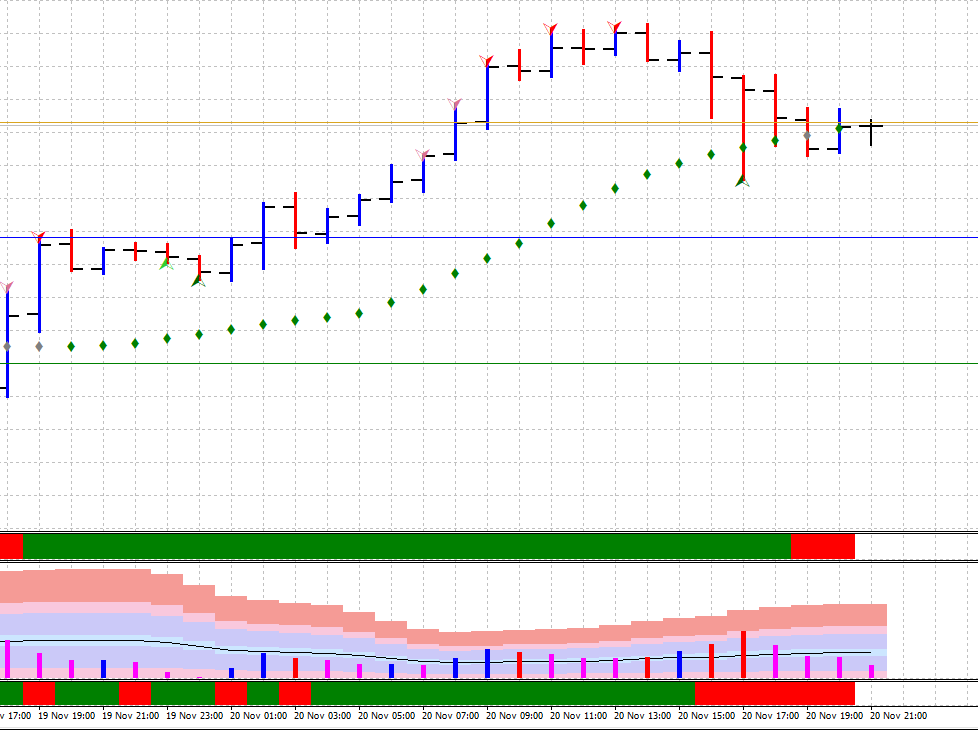

Upon entering the trade, the market displayed a series of narrow spreads with gradually increasing volume. This suggests supply was being absorbed by professionals. The price bars consistently closed in the middle or upper ranges, signalling underlying bullishness despite the low volume—a classic hallmark of stealth accumulation by strong hands.

A significant down bar emerged with a narrow spread and below-average volume, closing towards its lows. This initially appeared bearish, likely representing a shakeout designed to eliminate weak holders. However, the absence of immediate downside follow-through suggests this bar was a test for supply, confirming that selling pressure had diminished.

Following this, two narrow spread bars appeared, both closing in the upper range on decreased volume. Despite the low volume, the price continued its upward progression. By the third bar, however, the market showed potential signs of hesitation. The bar closed in the middle of its range with below-average volume, hinting that the upward move might be losing momentum. If supply were to re-enter the market, we would expect to see a shift to down bars.

Instead, the next bar confirmed strength, closing near its high with a wider spread and increasing volume. There were signs of weakness, “No Deamnd”, but they were completely ignored. This marked the onset of a classic markup phase where professional demand began to dominate. The increasing volume and strong closes solidified the bullish structure, highlighting that the market was firmly under the control of strong buyers.

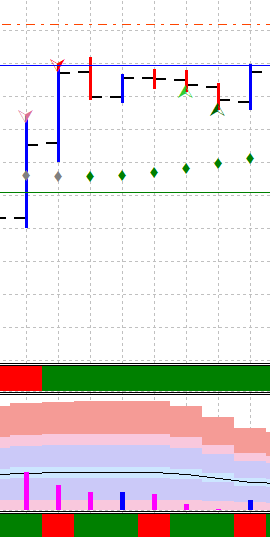

Second Profit Target

After surpassing the first profit target, there was a noticeable increase in volume, accompanied by a wider spread on the price bar. The bar closed at its highs with ultra-high volume, indicating that supply was entering the market. This was followed by an attempt to rally on the next bar, which had a smaller spread and closed towards its lows—an early sign of weakness entering the market.

At this stage, professional money often begins to distribute their holdings. They entice buyers into the market by pushing prices higher, masking their distribution efforts. The bar that followed was up, closing slightly off its highs with a decrease in volume—further evidence of waning demand. The subsequent bar confirmed the loss of momentum; it had a small spread, closed near the middle of its range, and lacked the characteristics of strength. The price then began to consolidate, showing a “mushrooming” pattern as volume decreased. Recognizing this shift, I moved my stop loss to secure profits at the first profit target.

As the market transitioned into a decline, the spreads of the down bars widened, and the volume began to increase. I exited the second leg of the trade when a widespread down bar appeared, closing near its highs with ultra-high volume—a classic shakeout orchestrated by smart money. Following this shakeout, the next bar was also down, but with decreasing volume, suggesting the selling pressure was subsiding.

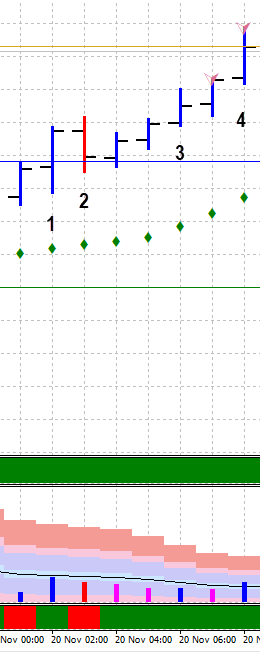

The End Result

| Trade 1 | Trade 2 |

|---|---|

| Trade Entry Date / Time: 20/11/2024 02:04:42 UTC | Trade Entry Date / Time: 20/11/2024 02:04:42 UTC |

| Symbol: USD/JPY | Symbol: USD/JPY |

| Type: Buy | Type: Buy |

| Entry Price: 154.755 | Entry Price: 154.755 |

| Position Size: 2.11 | Position Size: 2.11 |

| Commission: -10.55 | Commission: -10.55 |

| Trade Exit: 155.355 | Trade Exit: 155.375 |

| Trade Pips: 60 Pips | Trade Pips: 62 |

| Profit: $814.91 | Profit: $841.96 |

| Profit %: 0.81 | Profit %: 0.83 |

Leave a Reply