The Japanese Yen is showing signs of gaining strength, and this potential shift is catching the attention of market participants. As a Wyckoff practitioner, I rely on the principles of price action, supply and demand dynamics, and the behavioural patterns of composite operators to decode what the market is telling us. By applying Wyckoff’s methodology to the price charts of AUDJPY, I’ve identified key signals that suggest the Yen may be entering a phase of accumulation and gearing up for a fall in the price of the AUDJPY currency.

In this analysis, I’ll walk you through what I’m seeing across these major Yen pairs—phases of distribution, signs of absorption, and shifts in the balance between supply and demand. By understanding these structural changes, we can better anticipate where the Yen is likely headed in the near future. Let’s break down AUDJPY chart and uncover the story they’re telling through the lens of Wyckoff’s timeless principles.

The Japanese Yen Is Gaining Strength

The Japanese Yen is showing signs of gaining strength, and this potential shift is catching the attention of market participants. As a Wyckoff practitioner, I rely on the principles of price action, supply and demand dynamics, and the behavioural patterns of composite operators to decode what the market is telling us. By applying Wyckoff’s methodology to the price charts of AUDJPY, USDJPY, GBPJPY, and EURJPY, I’ve identified key signals that suggest the Yen may be entering a phase of accumulation and gearing up for a sustained move higher.

In this analysis, I’ll walk you through what I’m seeing across these major Yen pairs—phases of distribution, signs of absorption, and shifts in the balance between supply and demand. By understanding these structural changes, we can better anticipate where the Yen is likely headed in the near future. Let’s break down each chart and uncover the story they’re telling through the lens of Wyckoff’s timeless principles.

The chart above displays two critical bearish signals that align with Wyckoff’s methodology. The first notable sign of weakness is the trap upmove, characterized by a widespread down bar that initially entices traders to go long, only to sharply reverse direction. This kind of trap occurs when the composite operator, or “smart money,” uses market strength to lure in retail buyers before unloading their positions into the buying frenzy. What makes this signal even more significant is the preceding no-demand bar—a narrow spread bar on very low volume, which reflects a lack of buying interest from professional money. Together, these two events provide strong evidence that supply is overwhelming demand, a classic bearish setup.

The Trap Upmove Confirms the Weakness

The trap upmove bar confirmed the initial weakness and set the stage for further downside. However, the subsequent bar delivered an intriguing twist—it dropped significantly during the month but managed to close at the highs. This suggests that while supply was dominant early in the period, some demand emerged later, possibly as short-term players covered their positions. Wyckoff practitioners would interpret this as a temporary pause rather than a shift in the overall bearish tone. True to this outlook, the following two months saw a rally in prices, driven more by a lack of supply rather than genuine strength. This is evidenced by the lack of significant volume increases during the upward move—another hallmark of a rally with weak conviction.

Now we arrive at the most recent development: a no-demand bar that appeared two months into the rally. This bar stands out due to its low volume and narrow spread, signalling a clear lack of interest from buyers at these higher price levels. This no-demand bar has since been confirmed by the current month’s price action, which has failed to push higher and suggests a re-emergence of supply. However, one aspect of the current bar raises a slight concern—the volume for this month did not exceed the volume of the prior month. While it’s not ideal, the overall price structure still leans bearish, as supply appears to be gaining dominance.

From a Wyckoff perspective, the current sequence signals that the market is likely transitioning into a phase of renewed distribution. The trap upmove, no demand bar, and confirmation through subsequent price action suggest that the smart money may once again be preparing to drive prices lower. It’s crucial to keep a close eye on the upcoming bars—especially for signs of a significant increase in supply, such as widespread down bars on higher volume—to solidify the bearish case.

AUDJPY Analysis: Is the Currency Poised for a Continued Down Move?

The AUDJPY currency pair has been a fascinating study of market behavior through the lens of Wyckoff and Volume Spread Analysis (VSA) principles. After reaching a high of 1.09, the market saw a classic trap upmove in July 2024, triggering a significant downtrend that brought the price down to the 90.00 level. However, at this point, we observed a Potential Professional Buy, a key VSA signal that often indicates smart money stepping in to absorb supply. This marked the end of the decline and initiated a rally back to the 1.01–1.02 range. But now, with signs of weakness emerging, the question is: is the rally over? Let’s break it down.

Trap Upmove and the Shift to a Downtrend

The trap upmove in July 2024 exemplifies the composite operator’s tactics to mislead retail traders into taking long positions near the 1.09 level, only to reverse sharply. This widespread down bar was accompanied by high volume, indicating professional money offloading their positions. Following this trap, the AUDJPY fell to 90.00, signaling a clear supply-driven downtrend.

At the 90.00 level, we observed a Potential Professional Buy, a VSA principle that marks the exhaustion of selling pressure and the absorption of supply by professionals. This buying activity indicated that the composite operator was preparing for an upward correction. What followed was a rally back to the 1.01–1.02 range, but the market has since shown signs of weakness at these levels.

As AUDJPY approached the 1.01–1.02 resistance zone, classic VSA signals of weakness began to appear. Specifically, we see No Demand bars—narrow spread up bars with low volume—indicating that professional money is no longer interested in driving the price higher. These bars often act as a warning that the upward momentum is losing steam. Additionally, signs of supply entering the market at these levels further suggest that the rally is unsustainable.

The price has since “mushroomed over,” forming a rounded top pattern. This is a visual confirmation that demand is waning and supply is beginning to dominate, making it increasingly difficult for the price to sustain higher levels.

Breaking Out of Consolidation: Signs of Further Downside

Over the past two months, AUDJPY entered a period of consolidation, trading in a narrow range as buyers and sellers struggled for control. However, price recently broke down out of this consolidation, a bearish signal that indicates supply is now overwhelming demand.

Following the breakdown, the second bar exhibited a VSA principle of strength coming in, suggesting that professionals might have briefly supported the market to test for demand. But Thursday’s price action showed a failed rally attempt—while the bar closed higher, the below-average volume indicates a clear No Demand signal. Without sufficient demand, rallies are unlikely to sustain, and Friday’s down bar reinforces this bearish outlook.

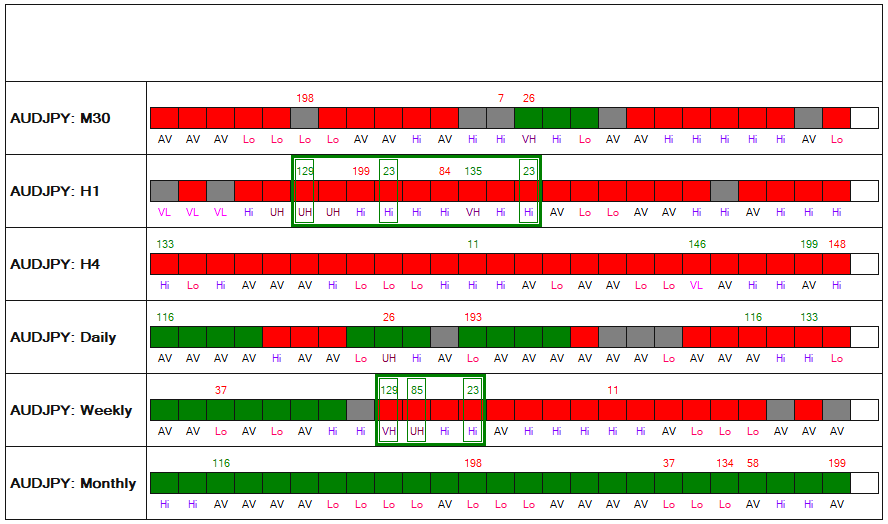

It’s also important to consider the broader trend. On all timeframes except the monthly, AUDJPY is in a confirmed downtrend. The lower highs and lower lows across the daily, 4-hour, and weekly charts indicate that sellers remain in control. The rally back to 1.01–1.02 now appears to be a countertrend move within the broader bearish structure.

For Wyckoff and VSA traders, this confirms the probability of further downside. The combination of No Demand bars, supply entering, and the overall trend alignment point to a continuation of the bearish move. Any rallies from here are likely to be met with selling pressure, making the path of least resistance downward.

In summary, the AUDJPY chart presents a clear bearish narrative: a trap upmove, signs of No Demand, and supply dominating at key resistance levels. The recent breakdown from consolidation and lack of demand on attempted rallies further support the case for a continued down move.

Traders should monitor upcoming price action for further confirmation, such as widespread down bars on high volume, which would signal increasing supply. With AUDJPY in a downtrend on all but the monthly timeframe, the odds favor lower prices in the near term.

Leave a Reply